Through a partnership with the cryptocurrency custody firm NYDIG, hundreds of banks in the United States will soon offer Bitcoin custody and trading services to customers — a move that could spur mainstream adoption of Bitcoin. The banking industry has attacked Bitcoin for years, and they’re still doing it. However, they’re suddenly incorporating it into their services and offering to let customers use it.

This is more than a classic case of ‘if you can’t beat them, join them’. Bitcoin is designed to negate the need for banking currency, because Bitcoin securely and reliably stores your coins on its blockchain — something that banks are trying to figure out in order to stay relevant. Unlike cash, Bitcoin isn’t something that you have to stuff into various corners of your couch. Any amount of it can fit on a tiny USB drive, which you can easily stow away in safe place.

Banks have been exploiting the fact that cash isn’t suitable for electronic transactions, therefore people need banking to facilitate international or electronic transfers. They lend your money and pay you low interest rates, while charging exorbitant fees for transfers, falling below the minimum account balance, deposits in some cases, and more.

Bitcoin does international transfers faster and cheaper than a bank can, and it provides a high degree of accountability due to its immutable blockchain. It also doesn’t charge you fees to keep your account open. You needn’t bank something that already has secure banking and transaction capabilities built right into it. Despite that, many people are going to deposit their Bitcoin into banks and be subjected to police state-esque surveillance and restrictions.

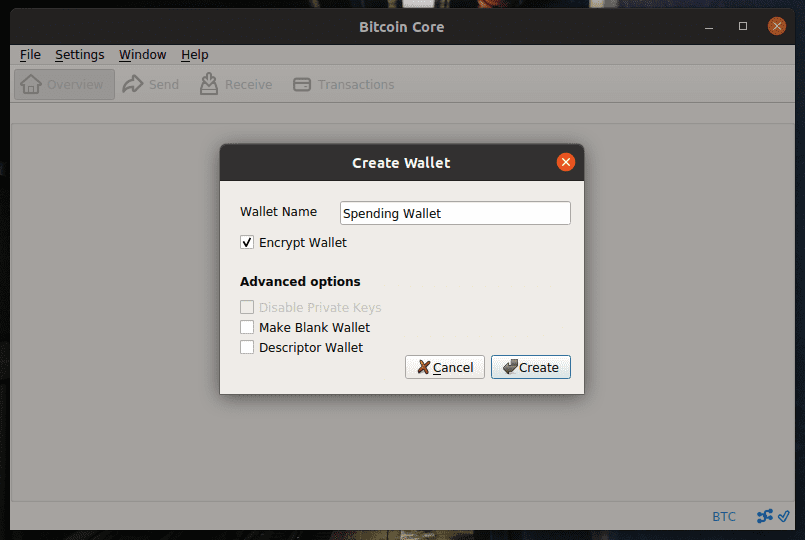

The discrimination that banks have been doing against low income and freelance customers will surely keep some Bitcoin out of banks — as some people won’t even be allowed to open accounts. That’s also why cash is still so widely used. Banks around the world are notorious for refusing customers because they don’t have enough money. Creating a standard, non-custodial Bitcoin wallet takes seconds and requires no branch visits or personal information. You also can’t be denied the ability to create a wallet.