The Reserve Bank Of Australia (Australia’s central bank) is launching an Ethereum-based Central Bank Digital Currency project as a proof-of-concept to explore the tokenization of a wholesale national currency. The digital currency would be used by wholesale participants to fund, settle, and repay tokenized syndicated loans.

Ethereum is one of the first decentralized platforms to run decentralized finance products (DeFi) such as decentralized exchanges (DEX — for example: Uniswap) as well as decentralized lending platforms (for example: Aave and Compound Finance). These decentralized finance products are dApps (these are just decentralized apps) running on the Ethereum platform, which is powered by a network of thousands of nodes and miners around the world (learn more about Ethereum).

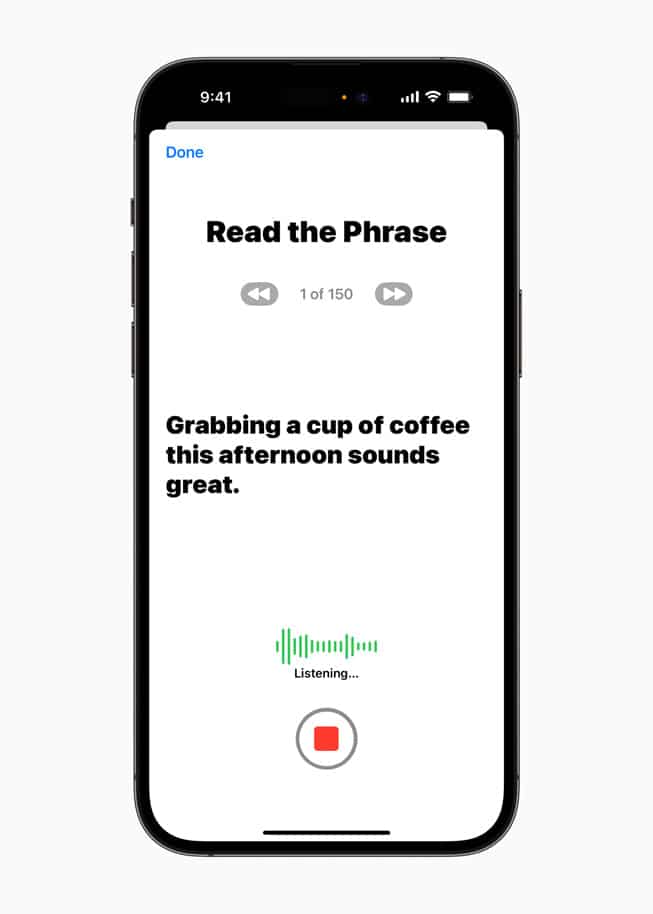

A dApp on Ethereum is a collection of one or more smart contracts that execute code to perform a task and/or automate activities. A smart contract is a set of instructions (code) executed by the Ethereum Virtual Machine (EVM).

Ethereum provides the benefit of being a globally accessible, level playing field that either individuals or governments can launch projects on. The Reserve Bank has partnered with Commonwealth Bank, National Australian Bank, and Consensys Software (a blockchain software firm) on the project to assess its viability.

Assistant Governor (Financial System) Michele Bullock said ‘With this project we are aiming to explore the implications of a CBDC for efficiency, risk management and innovation in wholesale financial market transactions. While the case for the use of a CBDC in these markets remains an open question, we are pleased to be collaborating with industry partners to explore if there is a future role for a wholesale CBDC in the Australian payments system.’