If you intend to use Bitcoin on your computer, smartphone, or even on a bunch of other devices, you can substantially reduce the risk of losing it all to theft by allocating funds to two different wallets.

What I’m referring to specifically is creating a mobile wallet and a separate desktop wallet (and not trying to export your desktop wallet to your mobile phone). One for saving, another for spending.

One advantage of Bitcoin over conventional payment methods is its ability to create new wallets (not just receiving addresses) with ease. As in, if you install a copy of a Bitcoin wallet app on your phone, you probably already have a new wallet! (if it asked you to write down or back up a recovery phrase, which is essential).

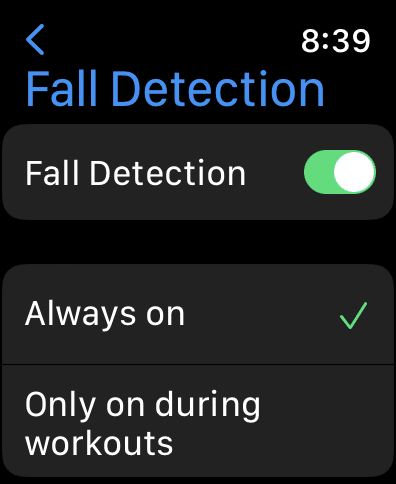

Once you’ve transferred only some of your Bitcoin to the mobile wallet (lets say 10% of it for spending purposes, while you have the other 90% in a Bitcoin Core wallet on your desktop), a person who steals your phone may be able to steal the coins in your wallet (always set a password!).

However, they may not necessarily be able to access the coins in your desktop wallet (unless you put your desktop wallet’s recovery phrase or password on your phone, which is not recommended).

Why Not Just Use A Service That Lets Me Log In From Any Device?

Using an online wallet service or exchange to store your coins and provide access to the same wallet on any device poses a major security risk, although it is convenient. Online services have to make your wallet accessible via a server (API in this case) so that you can just log in from any device you please.

This means that thieves can do the same thing by simply guessing your password. 2-factor authentication is not good enough to recommend such a service, considering that stealing your phone would make it easy to access the exchange or online wallet app that is on it.

You want to ensure that no more than that 10% of your Bitcoin is at the higher-risk of being stolen that a mobile device entails (phones are more likely to be stolen than desktop computers).