The rise of Bitcoin, Ethereum and other cryptocurrencies has spurred the creation of Central Bank Digital Currencies (CBDC). Bitcoin (BTC) is a digital currency and Ehereum (ETH) is too. Why are people so excited about the growth of CBDCs? One reason is the ‘legitimization’ of cryptocurrencies such as Bitcoin, and another possible reason is the much-overdue technological advancement of the banking system.

Regardless of country, conventional banks offer shamefully poor transaction performance and poor efficiency due to the high cost of even the smallest transactions. They also suffer from liquidity issues and are taking full advantage of little or no reserve requirements, which means they don’t have to have all your cash ready for a withdrawal.

This is more likely to be an issue if you want to withdraw a large sum of money. Banks often can’t conduct international transactions due to their fragmented nature (they can only do transfers to certain counties). Bitcoin is the first successful digital currency to achieve some degree of global adoption.

Bitcoin is designed to favor personal freedom. Banking isn’t quite like that. Banks are used to establish control over people for various reasons, including crime (the efficacy of banking surveillance and censorship against crime is another question) as well as the suppression of political opponents, journalists, whistle blowers, and also the banks’ competitors.

Bitcoin’s seamless, unrestricted ability to conduct transactions between any country in the world in a matter of minutes is actually the opposite of a CBDC. Why? A CBDC is controlled by one country’s government. Bitcoin is controlled (hardly) by the people.

Bitcoin is designed to distribute control over its network so widely that a single corporation or government can’t use it to abuse people (for example: censorship of activists, journalists, and protesters). How widely? Thousands of nodes and thousands of miners distributed around the world.

Instead of speculating it will be used to do, let’s look at what a Central Bank Digital Currency (CBDC) can do.

Central Bank Digital Currencies Bolster Authoritarianism

Entrapment – CBDCs Are Meant To Phase Out Cash

With decentralized digital currencies such as Bitcoin being merely an exception because they lack a central authority, digital currencies are in inherent threat to personal freedom because whoever owns them has total control over their users. One country’s government could, for example use their CBDC to block a whistle blower’s transactions with only a few clicks.

Digital currencies are also not physical cash that you can withdraw from an ATM. CBDCs are also largely intended to replace physical cash, which is why it isn’t likely that physical cash withdrawals would be available for long.

They may be temporarily redeemable for cash, but not permanently. Some countries such as Australia are already banning cash transactions over a certain amount and trying to force people into their banking system to facilitate surveillance and censorship. Crime and terrorism are usually cited as the reasons for this.

Censorship And Surveillance

The ability to censor or snoop on anyone’s transactions with a few clicks is another capability of central bank digital currencies. It wouldn’t be necessary to go through third-party banks or obtain warrants, because governments would have direct control over everyone’s accounts.

Companies already have to hold back government officials trying to collect data or interfere with people without warrants. Those pesky constitutional requirements (being sarcastic) would be easily circumvented with a CBDC. I’m not saying that Bitcoin is private, but it does offer some degree of anonymity.

This combined with increasingly aggressive KYC requirements means that thwarting a protest or obstructing a journalist could be done in seconds by freezing their funds/blocking all their transactions.

There have also been cases of authoritarian leaders freezing the bank accounts of opposing election candidates to prevent them from funding their elections. A few suspicious cases of censorship:

- Russia freezes opposition leader’s bank account, as well as his family’s accounts.

- Bank Of America freezes accounts of foreign residents.

- Beijing freezes CCP critic’s bank accounts.

- China freezes pastor’s account for involvement in Hong Kong protests.

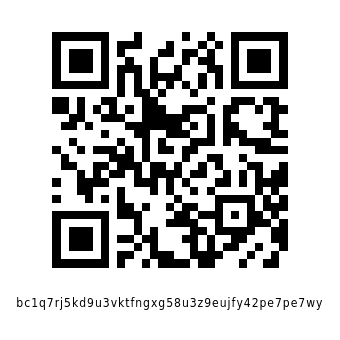

Donate Bitcoin

Or copy and paste: bc1q7rj5kd9u3vktfngxg58u3z9eujfy42pe7pe7wy

Further Reading

How To Create A Bitcoin Wallet